News & insights

What a difference a postcode can make

21st June 2019

The North East in renowned for its affordable properties. Buyers can frequently find homes to meet their needs, regardless of size or budget, at a fraction of the cost of houses in towns and cities further south.

In fact, in the most recent House Price Index (HPI) data, the North East was shown to have the lowest average house prices in the country at £125,233, making it £346,997 lower than the average in London and £195,941 lower than the average in the South East.

However, where you actually choose to settle down in the North East can also impact the price you pay, with some areas being well above the HPI average, and other areas where you can grab a bargain well below £125,233.

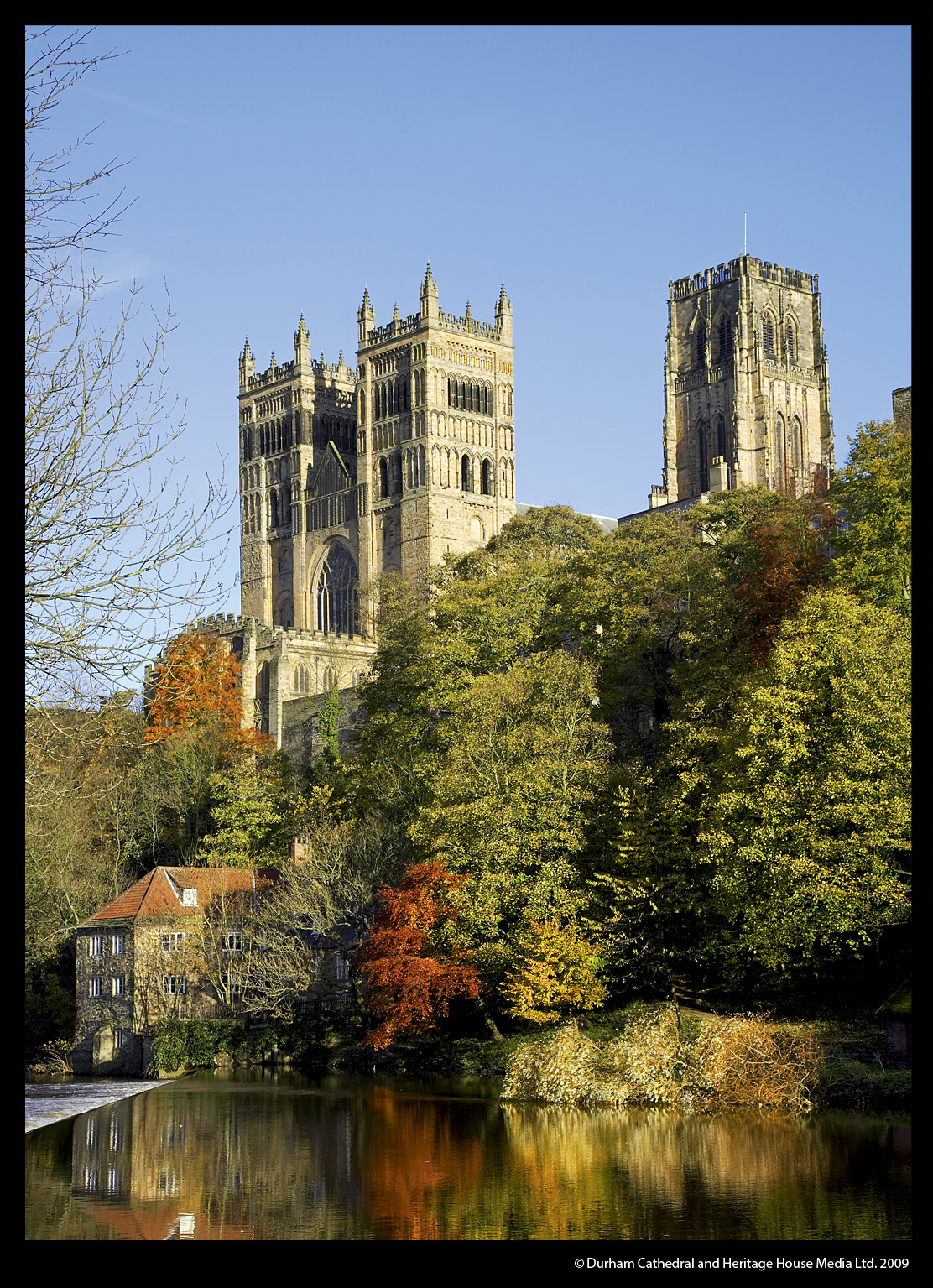

According to figures on Plumplot.co.uk, which gathers data from a number of official online sources, in County Durham and Tees Valley, the most expensive postcode area to buy a property in is Durham City (post code DH1 4) with prices averaging at £729,000. This is a huge difference from other areas in the region, with other DH1 postcode average prices ranging from £178,000 to £291,000.

Darlington’s DL3 8 postcode area was priced up at an average cost of £277,000, making it one of the most expensive areas in Darlington and Tees Valley as a whole.

Other areas that came in much higher than the average cost were Billingham, where the average price was £266,000, Sedgefield, where it was £262,000 and Yarm, where the average property price was £230,000.

At the other end of the spectrum, Peterlee’s SR8 4 and Middlesbrough’s TS2 1 postcodes came out as the best places for buyers on a budget, with the average prices properties coming in at £49,100 and £33,300 respectively.

Bargain hunters could also try their luck in Hartlepool TS24 7, which had an average price of £45,500, Thornaby’s TS17 7 area, which came in at £60,600 and Ferryhill, where properties cost an average £68,800.

It is worth noting that the prices quoted above are average only, and some properties could be more expensive than the average, and some could be cheaper, however these figures can offer a suggestion as to areas you can start looking in.

I spoke to Henry Carver from Nick and Gordon Carver Residential, who said: “The North East is a fantastic place for people to buy a property, as you get much more for your money than you would if you bought in the south. The commuter links from Durham, Darlington and Middlesbrough are excellent for those who choose to live in the area but work outside it, and plenty of job opportunities for those looking for work in the region too.

“Your estate agent will always do their best to find the right home for you, taking into account your budget, the size of property you need, and the local amenities you require. The average price figures for each area are a great starting point, as they can help you to consider where to look, narrowing the search down a bit.”

Please note: This article is intended as guidance only. No responsibility for loss occasioned/costs arising as a result of any act/failure to act on the basis of this article can be accepted by Latimer Hinks. In addition, no responsibility for loss occasioned/costs arising as a result of any act/failure to act on the basis of this article can be accepted by the firm.

By Martin Williamson, Head of Residential Property at Latimer Hinks Solicitors

Martin Williamson